Business Trust Seminar

ATTENTION - NEW TREND 2020

For Savvy Entrepreneurs and Investors...

James Billings

San Diego California USA

From the desk of TrustArte Founder, James

Before you do another Corporation or LLC – Read this First

Stop giving away your business data to strangers!

Remember your last business filing - let’s recap that wonderful experience...

- Navigate the Secretary of state website ok?

- Was your name preference available?

- How many pacman fees did you pay?

- Annual renewals done on time?

- How much junk mail did you get?

- Pay for a mail forwarding service?

- Did you hire a resident agent?

How much personal data revealed? - Pay contract officers or managers?

- All official minutes done on time?

- Corporate veil ever at risk?

- Wait for certificate of good standing to bank?

- What did you get for paying franchise tax every year?

- Didn't you lose control over your business data?

- How many other little surprises?

Ok - You Asked

In the olden days you didn’t have any other choice except to endure the secretary of state demands. And what did you get? Government permission and your business data published online. And if you own real estate in an LLC those details are published on the County Recorder’s open website.

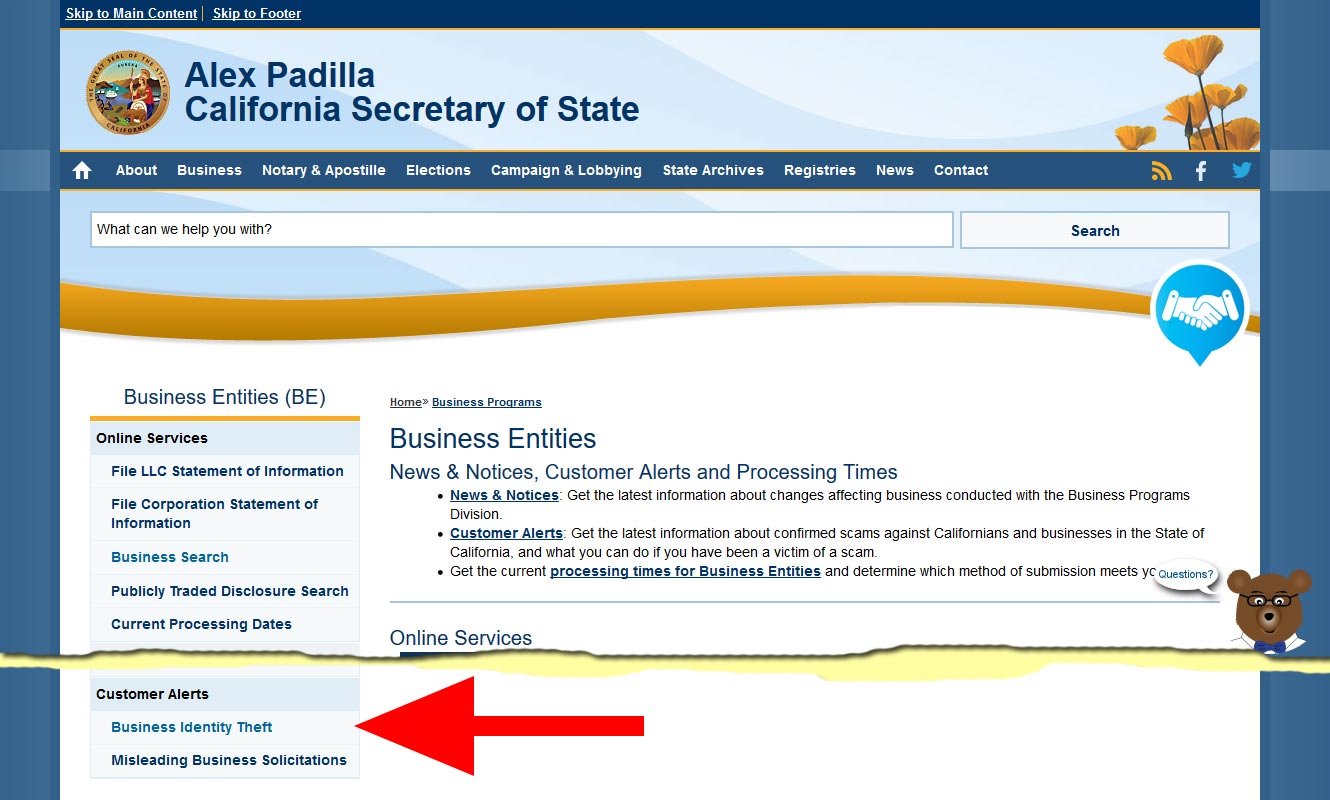

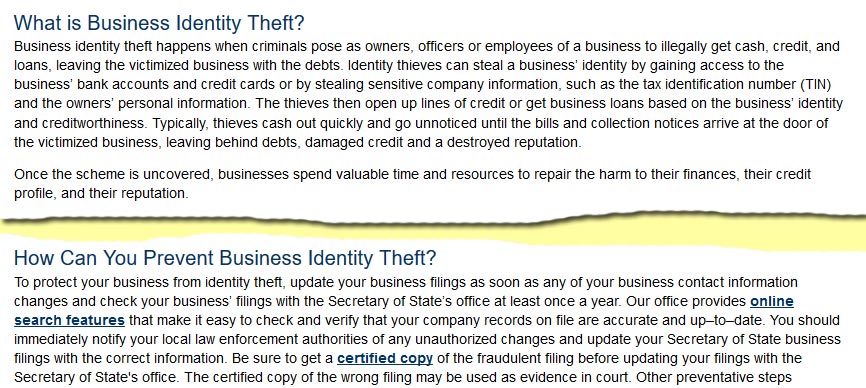

This valuable data posted online exposes you to Business Identity Theft. The state of California publishes an explicit warning on their business portal...

Watch this short video about identity theft and Secretary of State fraud in Nevada.

Thieves replaced an LLC Manager and illegally borrowed $2,000,000 against real estate.

The real owner now has $400,000 legal fees and 4 years of headaches. Don't say it couldn't happen to you too...

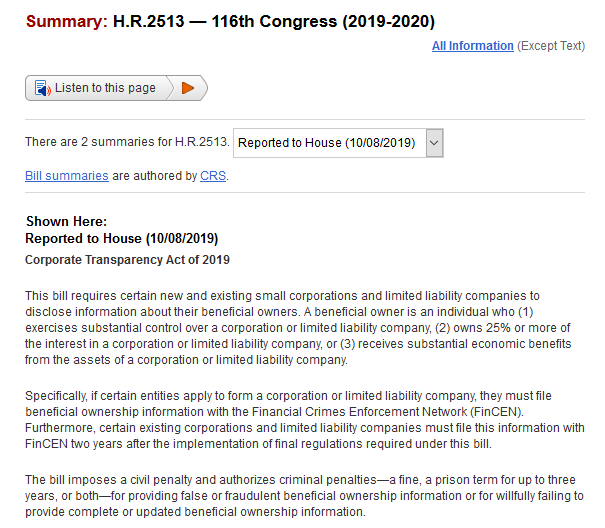

On top of that, the year 2020 is upon us. The internet and government are more pervasive than ever in our lives. Congress approved a bill called H.R. 2513 that will soon unmask all LLC and Corporations nationwide.

It’s time for a new approach to business organizations and data privacy. Let’s step back in history and fast forward to today.

Centuries ago corporations were charters issued by the government to political friends and cronies. Translated, this meant legalized monopolies. Smart businessmen on the outside needed another solution. They wanted to join together as an association, invest money and have limited liability.

Their inventive solution succeeded very well. It remains in use today on a global scale representing trillions of investment dollars. What was their solution?

The Business Trust

Where can I see it today?

Look at Mutual Funds - they’re often organized as Business Trusts holding $21 trillion of assets in the USA. Then you can read a REIT offering memorandum. They’re business trusts too, holding $3 trillion of gross real assets with very specific tax rules. Pension Funds holding $6 trillion of assets are often business trusts.

Industrialists from the early 20th Century such as Carnegie, Rockefeller and Kennedy’s use them too. Billionaires long ago pushed aside corporations for private Business Trusts.

Now that we’ve validated the organizational structure how can you use it?

Just like you would a corporation or LLC – except without government hassles and publicity.

Think of your personal living trust – does it pay the state any fees? Do you tell anyone outside your family about the details? Do you register it anywhere? Heck NO

Then let’s use a commercial business trust. Repeat - no state fees, no telling outsiders, and no registration*.

*California, Illinois, New York, et al.

James Billings is the author of

The UnCorporation, a newly published book on Business Trusts.

What Can Your Business Trust Do?

Operate a Business

Invest in the Stock Market

Own Real Estate

Keep a Stealth Bank Account

Act as a Nominee

Self Directed IRA-ROTH

Lower your Tax Audit Profile

Protect Equity with Debt

Prevent Business Identity Theft

Secretary of State Fraud Prevention

Asset Protection Camouflage

Combine with LLCs & Corporations

Protect Assets from Future Liens or Judgments

and much more!

What’s the difference between a mutual fund business trust and our business trust?

They run a public business with investors and register with the state to comply with securities laws. We run a private business and exempt from registering in most states. We like this because it keeps our data private and off the internet radar screen.

What’s the difference between Carnegie, Rockefeller and Kennedy business trusts and our business trust? We use them very much the same, no telling outsiders.

What are the drawbacks of a business trust?

It depends upon what drawbacks mean to you. Not having to register, not having a resident agent, not having internet presence, not having to do annual meetings. What are the drawbacks to having a living trust?

What are the drawbacks of using a corporation or LLC?

You leave yourself open to secretary of state fraud and business identity theft. Hackers these days can swap out your LLC Manager or Corporate Officers and you’d never know it until too late. All your business data is available online.

How do I get one?

For those who want a real tough slog – cut, copy and paste various trust declarations you find scattered around the internet. Then you get to sort out multiple tax issues, legal factors, trustees, grantors, beneficiaries, your living trust, investors, employees, how & where to do banking, state registrations, business credit, etc.

In other words you can spend a tremendous amount of time trying to pull it all together and hopefully you’ve got it all right. If you fantasize free or cheap forms to run your business, go for it.

Your Professional Guide

Any high school kid with a computer can sell blank LLC or Corporation forms on a faceless website. But how many people can strategically guide you through setup of a business trust? On one hand, start the count…

We can and we do – with the how and why you connect each piece. It’s called “context.” It’s also called “applied knowledge.” This means you can get it done easier and smarter in less time.

Get the comprehensive business trust seminar!

Includes strategy questions, document templates, tax and legal information, banking tips and secrets. All in one package. We’ve made it simple and clear for you to get it done right and quickly.

You get a comprehensive "owner's manual" and quick start guide. It's not what you have, it's how you use it!

How Much Time Does it Take?

Just a few quiet afternoon hours!

Answers to all these questions and much more inside the online seminar...

Can it have Employees

Can it build Credit

Does it need to Register with the State

How does it get Taxed

Why do I need Multiple Business Trusts

What Assets go In

How to Get Them in

What Assets Stay Out

What is Doing Business

How & Where to Do Banking

How it fits with my Living Trust

Does it Work with my LLC

How does it get Sued or Sue

How to get Utilities Account

Why Trustarte?

Because the founder James has expertise with various types of trusts for holding title to assets. This accidentally happened as a result of his professional experiences as a securities broker, corporate pilot and real estate broker.

In every situation, title to assets was always important. "James, how do we keep it safe?"

He realized that asset title never received proper recognition by accountants, lawyers, escrow agents, real estate agents, financial planners, etc.

They carelessly suggest INC/LLCs without knowing the full consequences. These are the people who SHOULD advise you about trust vesting, but they don’t. The reason is because they never learned. They're not title experts, they're transaction people. That’s why James expertise is scarce and valuable.

What if you could get his personal guidance? What if you could get one of his turnkey online solutions?

If you want to see LLCs and Corporations in the rearview mirror, then get a business trust setup. You’ll never look back…

Over the years clients asked me a million trust questions. So I also published a book on business trusts last year. It includes a little of my personal history how this came about, background on business trusts, and how you can use them.

Private clients ask us to review their entire portfolio. We first look at how they hold title. Here's an example...

Suppose I told you one guy had multiple rental properties held in 27 California LLCs. The franchise taxes alone were $21,600 each year.

He deeded title to 27 trusts then dissolved 26 LLCs to eliminate and save $20,800 in annual taxes. Is this guy happy?

But many people asked us for a DIY business trust. So we created an online seminar for you.

The BTS helps you do it. Discover important strategies to customize a business trust specifically for your needs.

You’ll read questions you’ve never even thought of. Each person has different circumstances so it’s personalized for you.

Three Easy Steps

- Follow the multimedia instructions paperwork

- Get a tax number and open bank account

- You’re ready for business

The Business Trust Online Seminar is $897

Think for a moment…in California you’d pay $800 franchise tax alone for a corporation or LLC – each year plus secretary of state and resident agent fees.

Using 3rd grade math - $800 x 3 years = $2400 just in taxes. Plus all the other fees you have to pay. What about Inc/LLC number two or three? Easy, just hit the multiply button!

With the seminar create business trust number two or three - all included - zero extra cost. Can you see the huge savings here?

It’s a 99% guarantee your CA corporations & LLCs are more expensive!

Plus I’ve included two BONUS reports – Personal Estate Trusts and Realty Land Trusts - each valued at $497 – more special knowledge and insights you won’t find anywhere else.

* New for 2020 - Offshore Banking and Business Organizations

With everything in the online seminar and bonuses you’ll discover a new world. Only a business trust gives you "anonymity control" over who sees or doesn’t see - your business and its assets.

To Your Success,

James

p.s. quick recap – replace Corp or LLC with a Business Trust. Get the online seminar for $897. It’s powerful, effective, and very private. Buy it here

© 2020 TrustArte. All Rights Reseved.