A GUIDE FOR THE ENGAGED!

How to Get an Easy Prenup WITHOUT

Risks or Hassles

James Billings

San Diego California USA

By James Billings, Founder of TrustArte

Congratulations - You’re Getting Married!

If you’re reading this there is a good chance you’ve decided about getting a prenup. After all, a prenup is a form of insurance. We don’t want to use it, but it's good to have it just in case.

What is the main purpose of getting a prenup? To have some form of protection for your marriage assets in case things don't work out. A prenup agreement lists all assets from both spouses then describes a divorce workout plan.

But as you're thinking about a traditional prenuptial agreement before getting married, you need to consider three problems that are inherent to traditional prenups. Here are a few problems you might encounter...

- Money and Time

- “That” conversation and the signature issue

- Court Challenges

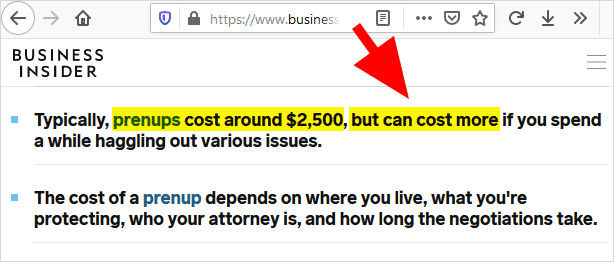

Problem 1: Money and Time. According to Business Insider, the cost of a traditional prenuptial agreement is about $2,500 dollars. Other sources place the cost of a prenup at at a much higher price depending on the complexity of the prenuptial agreement and how many hours an attorney puts into drafting it, since attorneys charge by the hour.

Excerpt from Business Insider article, October 20, 2018.

Even if you were to get a pre-made prenuptial agreement from legal form website, the cheapest ones cost almost $1,500 dollars and close to $2,000 in some cases. And there’s no guarantee that the agreement will work. Keep on reading to see why.

You also have the time factor. It takes time to discuss the agreement with your fiancé, both disclose all assets and schedule time with attorney. The lawyer will draft the agreement, itemize all real estate and bank accounts for both soon to be newlyweds, edit for omissions or accuracy, then another visit to sign it. Time is just as valuable as money when your on countdown to the wedding date.

Problem 2: “That” conversation. Actually asking your fiancé to disclose his or her financial condition and assets, and then sign a prenup. This is a very invasive process and no hiding allowed. That bank account your mother setup for your future must be disclosed too.

This is perhaps the most difficult aspect of a traditional prenuptial agreement: having to discuss it with your spouse, get an agreement then two signatures. You will need to disclose what kind of assets you have (not disclosing assets can jeopardize a prenup) as well as liabilities, who is going to get what, etc.

And that’s assuming the prenup is not going to spoil the romantic period before the wedding or cause the wedding to be called off. Can you hear this question, “are you more concerned about money or love?”

Problem 3: Court challenges. Even after a prenup agreement is signed with the full consent of both spouses, it can still be challenged in court. A prenuptial agreement is essentially a marriage contract between the two spouses. And precisely because it is a contract, it can be challenged even if you pay top dollar to an expensive lawyer. In fact, some law firms specialize in challenging prenuptial agreements in court.

Want an example of a prenup invalidated in court? Here’s TWO: Donald Trump’s and Steven Spielberg’s.

It’s true. Donald Trump had 4 prenups with his first wife Ivana Trump. One signed before their 1977 marriage and 3 follow up prenups. When they divorced in 1987, a New York court invalidated the last version of the prenup because Ivana successfully argued she did not have proper legal representation when she signed it. Why? Because the lawyer Donald Trump got her to look over the prenup worked with Trump’s personal lawyer at the time.

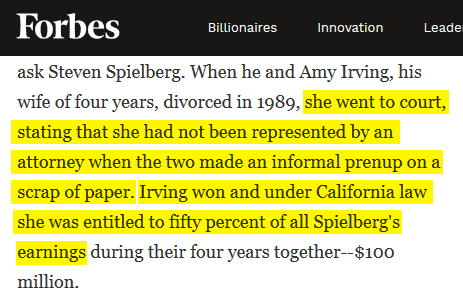

In the case of film director Steven Spielberg, Forbes Magazine published in 1997 that Spielberg’s prenup with his wife Amy Irving was also invalidated because a court in California found Irving was not properly represented by a lawyer when they signed an informal prenup in a scrap piece of paper. As a result, a Judge declared that Irving was entitled to half of Spielberg’s $100 million fortune.

Excerpt from Forbes magazine, July, 19, 1997.

That means that at least in California and New York, signing a prenup without one of the spouses being represented by a lawyer can invalidate the prenup agreement.

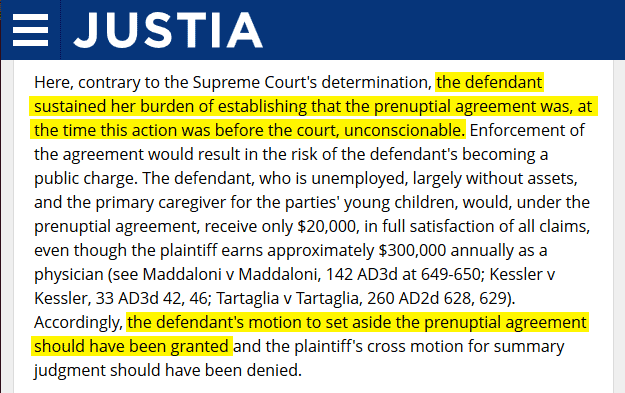

In fact, a court can invalidate any prenup if the court finds it to be “unconscionable.” That is, even if the prenup seemed fair at the time of marriage, the court can determine it is unfair at the time of the divorce and invalidate it. That has already happened in a court in New York in 2018. A court decided that the terms of the prenup were unfair to the wife because at the time of the divorce the wife was unemployed and took care of the children...

Excerpt from the 2018 decision by the Appellate Division of the Supreme Court of the State of New York on Taha v Elemity, which revoked a prenuptial agreement on the basis of being unconscionable at the time of the divorce.

So no, a conventional prenup is not a guarantee.

Now, remember how Steven Spielberg’s prenup got invalidated because his wife didn’t have proper legal representation when they signed it? That means that if you don’t want the prenup challenged in court, you don’t just have to ask your fiancé to sign a prenup; You have to ask your fiancé’s lawyer review it before signing.

And that can REALLY spoil the romance.

Oh, and by the way: a court can also invalidate a prenup if it’s signed too close to the wedding date. For a prenup to be valid, both spouses require enough time to fully understand what they’re getting into when they sign it. So if the prenup is signed a few days before the wedding, the probability of getting the prenup invalidated increases.

So a conventional prenup can have nasty surprises during divorce proceedings. How could you have known the future?

In other words a regular prenuptial agreement is complicated!

ISN'T THERE SOMETHING EASIER?

YES - a Prenup Trust

What is that?

It's a Trust for your pre-marriage assets. What you do is transfer what you own personally before marriage (real estate, bank accounts, stocks) to a private trust that you control.

For example: your savings account, stock in a startup, a house, a rental property, or an inheritance.

A living trust distributes your estate. A prenup trust holds your assets.

There is no need to discuss any assets in a prenup trust with your new spouse. You can always share any of it with your spouse at a later date, but think of it as a one way mirror for now.

The transfer of your real estate, bank accounts and stocks to the trust is relatively simple. And since they are owned by the trust, they are NOT part of joint ownership assets. As long as you do not financially share them with your spouse, this generally keeps them safe from divorce proceedings.

In other words, if you fail to use a trust, any bank accounts or property in personal name can be in jeopardy. But if the bank account or other property is owned by your trust and never mixed in with marriage assets they can be very difficult to challenge in divorce court.

James Billings is the author of

The UnCorporation, the most comprehensive book on Business Trusts.

A Prenup Trust is Safer than a Prenuptial Agreement for pre-marriage assets in the following ways:

1. A Prenup Trust is far less expensive. It costs less than half the price of a traditional prenup and there’s no need to hire a lawyer to draft it. It can be done much faster too. No waiting.

2. It can be very difficult to challenge in court. Since the trust is a legal person outside the marriage its assets are never held as joint property to be split up in divorce. The idea is that your spouse never acquires legal title to those trust assets while married to you.

3. It avoids “That” Conversation. You can setup the trust quietly without telling anyone. No need to share with fiancé. No need for two signatures. No need for a lawyer.

AVOIDING FINANCIAL RISKS

The Prenup Trust can avoid many financial risks, including:

1. Debt Liability - Let’s say your spouse borrows money to attend college after getting married. This supposes you both jointly signed for credit together. That means the debt is in your name too. In the event of a divorce, the debt is still valid no matter who does or doesn’t pay. Which means creditors can come after your personal bank account and property even if you are no longer married. However, bank accounts and property owned by your Prenup Trust, are generally safe from creditors.

2. Inheritance. If at some point in time you receive an inheritance personally or with a prenup agreement, a divorce might let a spouse claim part of that inheritance. But if the inheritance is received directly into a Prenup Trust, generally your inheritance is safe.

3. Second or Third Marriage. Let’s say you get married for a second time. But you have children from your first marriage. You want to make sure your money and assets can be enjoyed by your kids from the first marriage.

A second marriage can make things difficult or even worse if you get a second divorce. But if your pre-marriage bank accounts and assets are owned by a Prenup Trust, you can distribute money or property directly to your kids.

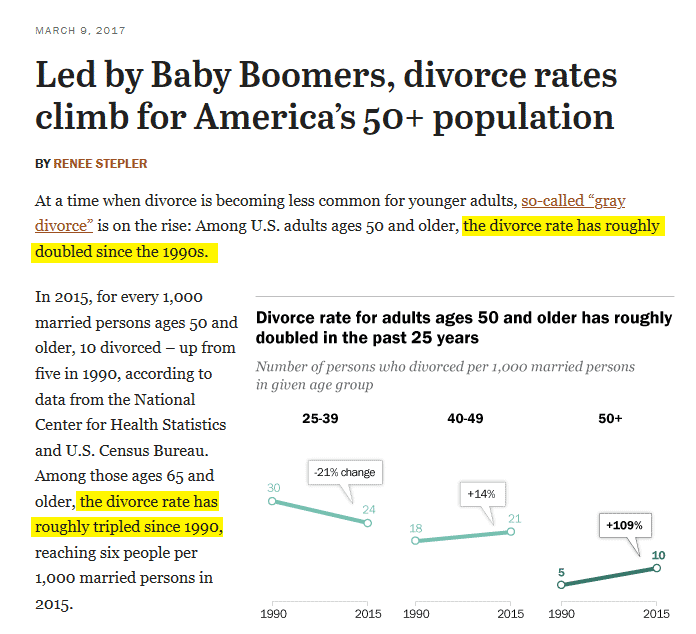

4. Retirement Funds. According to a Pew Research Poll, divorce rates among the elderly are increasing. The problem is people who are 50 years or older are more likely to have assets such as retirement funds that can be challenged in court during a divorce. But if the retirement funds are correctly directed to a Prenup Trust, they generally remain safe from divorce court.

Results from a 2017 Pew Research Poll on divorce rates in America.

WHY HAVEN’T I HEARD ABOUT PRENUP TRUSTS BEFORE?

Because nobody bothered to fix the problems that come with traditional prenups until we came along.

Prenup Trusts were developed by TrustArte after we realized there are many problems inherent to traditional prenuptial agreements. You'd think lawyers would have designed a contemporary solution. Nope.

Even though problems with traditional prenups have been in the media for decades, attorneys have never bothered to update their thinking. What's important to them is not necessarily what's best for your assets.

We are the first to design this modern strategy solution. Prenup trusts are really quite simple. You need guidance to get all the paperwork done right. But you can do it.

Since 1995 we help people setup trusts for owning Businesses, Real Estate and Bank Accounts. After seeing problems with prenup agreements, designing a easy Prenup Trust just made sense.

We’re the first to recognize your unique problem and design a solution. All you're doing is changing title from 'you to your trust.' It's simple and clean.

WHAT A PRENUP TRUST DOESN’T DO

The prenup trust is ideal for safely owning pre-marriage assets. It has no effect upon any earnings or property you acquire after getting married. Any assets or earnings acquired during marriage are subject to joint property disposition.

Again, the prenup trust is designed to hold pre-marriage assets.

In other words a Prenup Trust is much easier!

HOW DO I GET A PRENUP TRUST?

You can get it from us. The Prenup Trust Seminar is designed so people can easily create their own Prenup Trust. It contains a complete set of instructions and documents to do it right.

And you can expect support from us for your success. If you want outside legal assistance you don't need an expensive lawyer. Just get a paralegal to help you do the paperwork.

With the Prenup Trust Seminar - follow the instructions, fill out paperwork, get it notarized, and you’re done.

Three Easy Steps:

1. Make a List of Assets

2. Create the Prenup Trust

3. Transfer the Assets

A Final Note -

You can go with the standard prenup which is rather complicated but hey maybe it's ok. But for those who prefer an easier quiet solution the prenup trust is better for you.

To Your Happiness,

James Billings

p.s. quick recap - get everything you need to quickly setup a prenup trust. After the New Year 2020 pricing is $895 for the seminar. But you can get 40% discount at $497 right now.

I WANT THE PRENUP TRUST!

Here’s what to do next - follow the link below. The wedding day is closer than you think!

Get a Prenup Trust and Bonus Report on Marriage Finance

© 2020 TrustArte. All rights reserved.

Developed by HOG Digital Lab